Mark Your Calendar

Sustainability

March 3-4 | Austin

Agenda items include:

- Climate Risk, Adaptation & Resilience

- Decarbonization & Emissions Target Setting

- AI, Technology & Electrification Challenges

- Investor Expectations & ESG Reporting

- Managers Only: Vendor Survey

Hispanic Real Estate Roundtable

April 23 | NYC

Agenda items include:

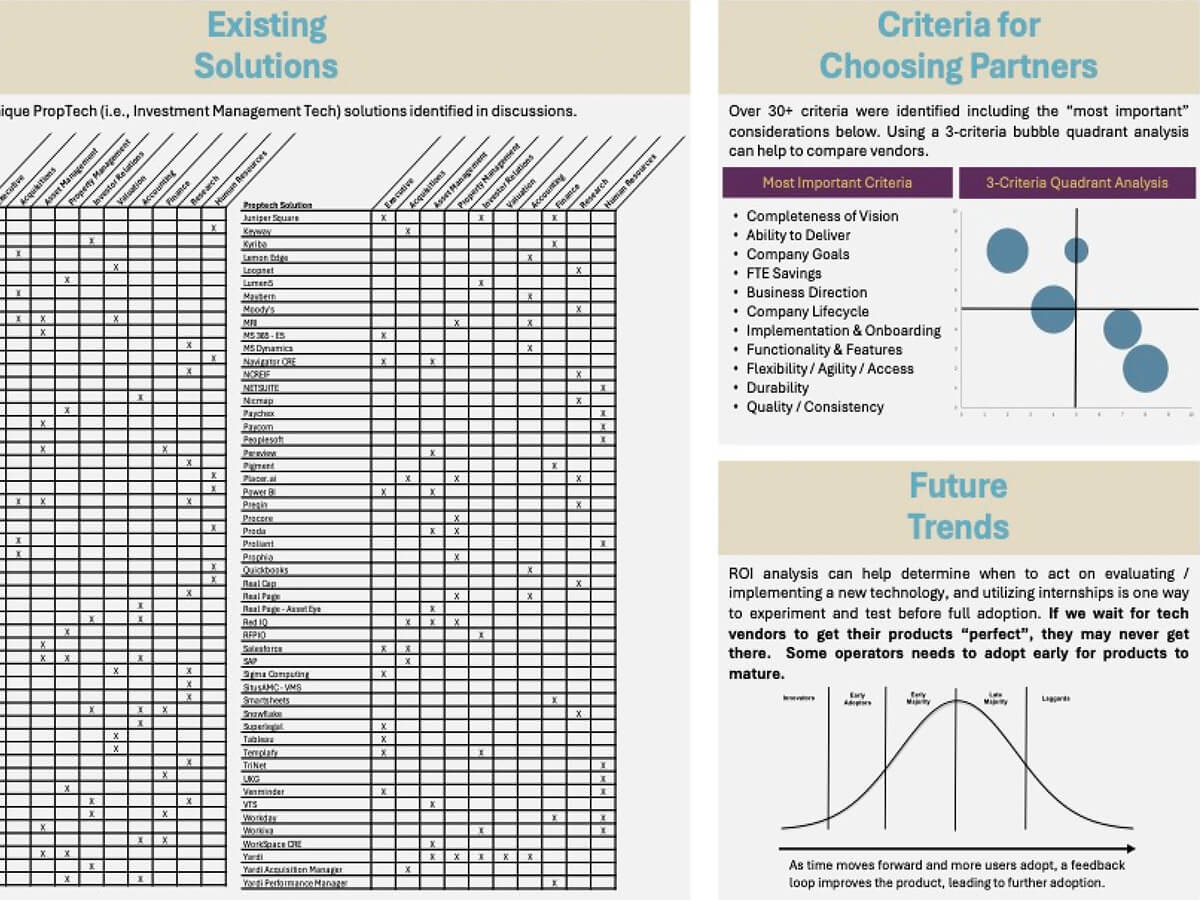

- How to Better Utilize Technology & PropTech

- Career Coaching & Navigation

- State of the Market Update

- Mentorship & Career Tracks

- Keynote Speaker Q&A

NAREIM Highlights

A quick snapshot of what’s happening at NAREIM. Explore meeting summaries, pulse survey results, member-authored thought leadership.

Amid Industry Transition, Global Real Estate Workforce Survey Highlights How Firms are Approaching Talent and Culture

Conducted biennially in collaboration with Ferguson Partners and supported by 19 leading commercial real estate associations globally, the Survey examines workforce demographics and internal practices across North America.

Read MoreThe New Members NAREIM Welcomed in 2025

In 2025, NAREIM welcomed Apollo Global Management, DRA Advisors, GID, Greystar, Goodwin Procter, Hines, Northwood Investors, and The Amherst Group as new members of our community.

We look forward to connecting and collaborating in the months ahead.

Read MoreNAREIM’s 2025 Resume Book is Live

NAREIM’s 2025 Resume Book, a key component of our student programming and commitment to developing the next generation of industry talent, is live and available for download via our Member Portal. This year, nearly 950 undergraduate and graduate students from 75 schools submitted resumes for consideration by NAREIM members.

Read More